Condo Insurance in and around Aubrey

Unlock great condo insurance in Aubrey

Quality coverage for your condo and belongings inside

Calling All Condo Unitowners!

The life you cherish is rooted in the condo you call home. Your condo is where you laugh and play, unwind and chill out. It’s where you build a life with the ones you love.

Unlock great condo insurance in Aubrey

Quality coverage for your condo and belongings inside

Protect Your Condo With Insurance From State Farm

You want to protect that significant place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as wind, freezing of a plumbing system or lightning. Agent Tim Holland can help you figure out how much of this fantastic coverage you need and create a policy that works for you.

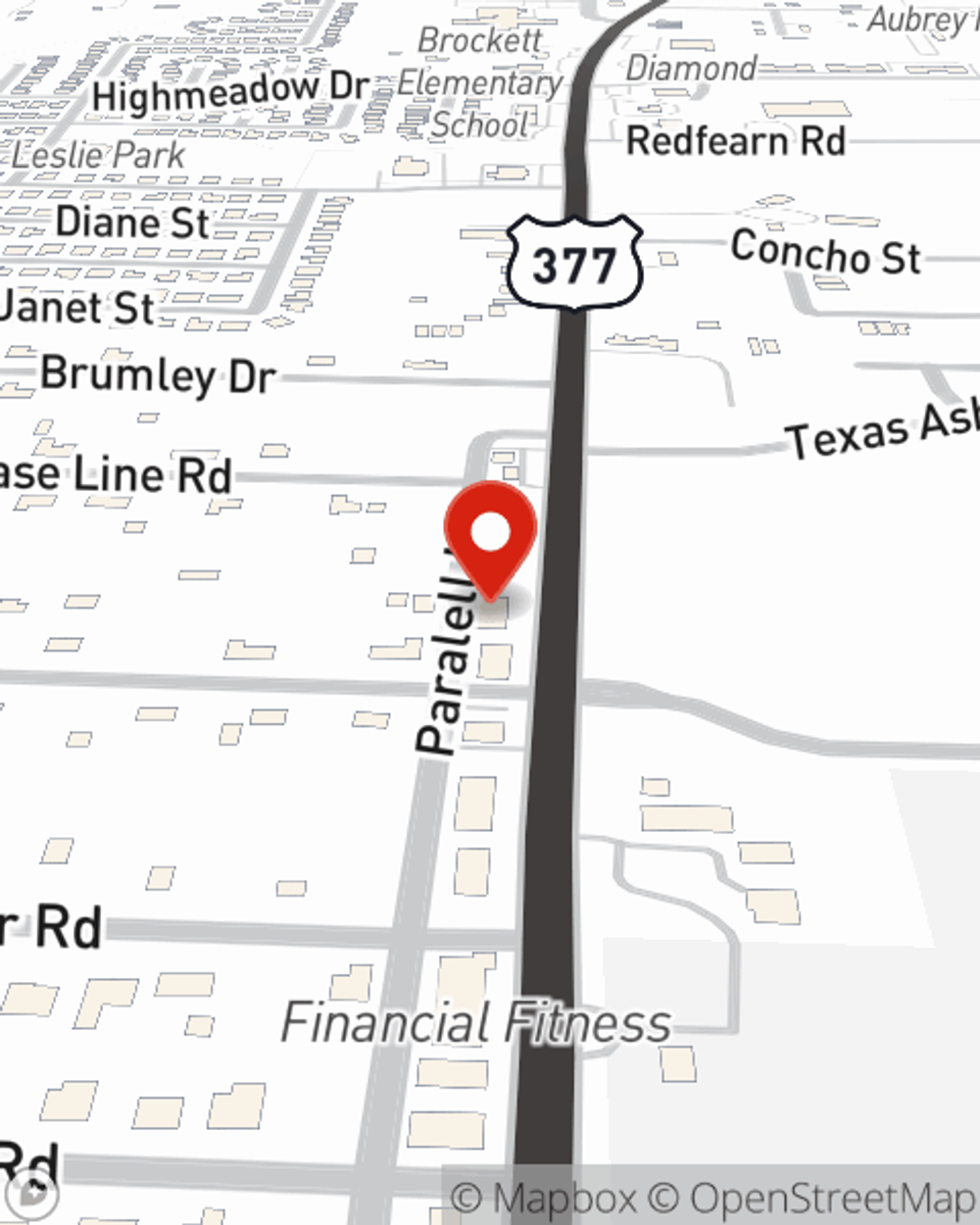

When your Aubrey, TX, condo is insured by State Farm, even if the unexpected happens, State Farm can help cover your property! Call or go online now and see how State Farm agent Tim Holland can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Tim at (940) 365-9449 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Tim Holland

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.