Renters Insurance in and around Aubrey

Your renters insurance search is over, Aubrey

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Calling All Aubrey Renters!

Your rented condo is home. Since that is where you spend time with your loved ones and kick your feet up, it can be advantageous to make sure you have renters insurance, even if you think you could afford to replace lost or damaged possessions. Even for stuff like your stereo, lamps, table and chairs, etc., choosing the right coverage can help protect your belongings.

Your renters insurance search is over, Aubrey

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented townhome include a wide variety of things like your desk, exercise equipment, cooking set, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Tim Holland has the dedication and experience needed to help you choose the right policy and help you keep your things safe.

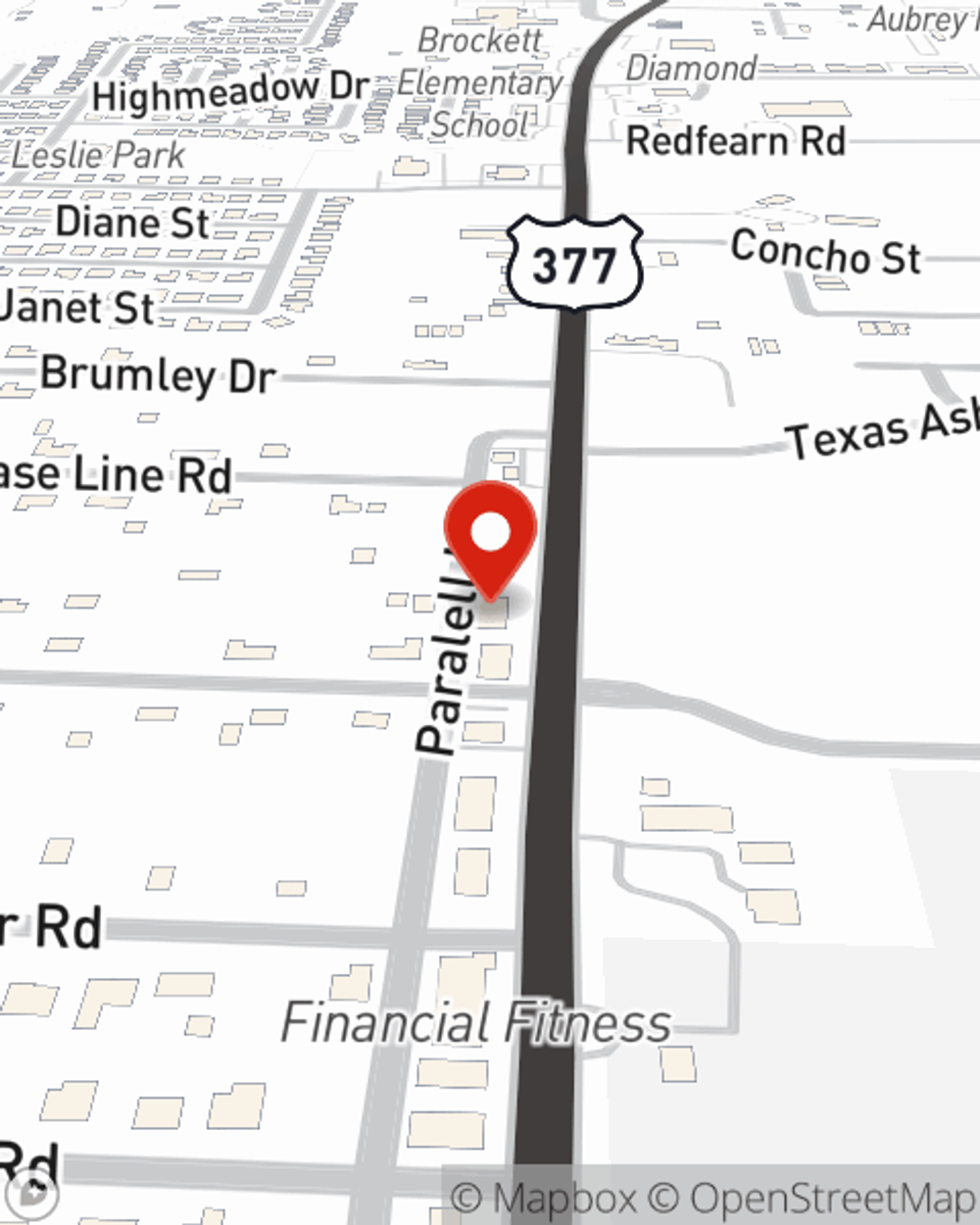

Renters of Aubrey, call or email Tim Holland's office to get started with your particular options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Tim at (940) 365-9449 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tim Holland

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.